WA Barnes LLP, Chartered Surveyors, was established in 1932 and has practised in the North Nottinghamshire area ever since.

Retail

From £5,466 Per Annum

Full Details

Industrial Unit

£25,000 Per Annum

Full Details

Land - Building Plot

Asking Price £1,785,000

Full Details

3 Bed Bungalow - Detached

Offers Around £210,000

Full Details

3 Bed House - Terraced

Asking Price £105,000

Full Details

3 Bed House - Semi-Detached

Offers Around £185,000

Full Details

3 Bed House - Terraced

£750 PCM

Full Details

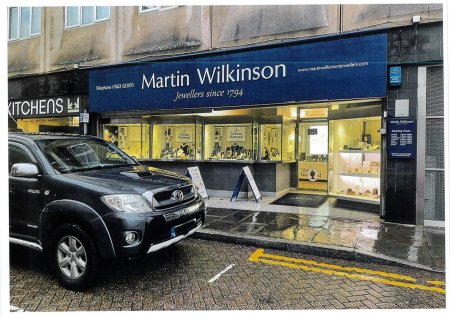

Retail

£11,000 Per Annum

Full Details

Office

£350 PCM

Full Details

4 Bed House - Detached

£290,000

Full Details

Industrial Unit

£4,800 Per Annum

Full Details

3 Bed House

£80,000

Full Details