WA Barnes LLP, Chartered Surveyors, was established in 1932 and has practised in the North Nottinghamshire area ever since.

3 Bed House

Offers Around £175,000

Full Details

3 Bed House

Offers Around £200,000

Full Details

3 Bed Bungalow - Detached

Offers Around £235,000

Full Details

2 Bed House

Offers Around £95,000

Full Details

3 Bed House - Terraced

Offers Around £85,000

Full Details

Land - Building Plot

Offers Over £250,000

Full Details

Office

£4,000 Per Annum

Full Details

Office

£375 Per Annum

Full Details

Industrial Unit

£4,800 Per Annum

Full Details

3 Bed House - Terraced

£750 PCM

Full Details

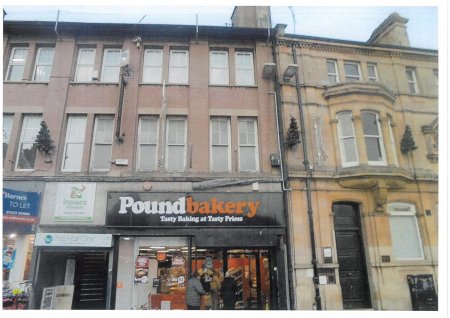

Commercial

Asking Price £125,000

Full Details

2 Bed House - End Terrace

£139,950

Full Details